TLDR:

- Netflix shares have surged 25% since April, outperforming the S&P 500’s 4.1% gain

- The company is approaching a $500 billion market cap, with shares trading at $1,173.25

- Netflix’s ad-supported tier now has 94 million monthly active users, up from 70 million in November

- Analysts remain bullish with price targets up to $1,230, citing ad revenue growth potential

- Despite high valuation at 43 times future earnings, Netflix’s expected earnings growth may justify the premium

Netflix continues its impressive run in 2025, emerging as a standout performer in a challenging market. The streaming giant’s stock has jumped 25% since early April, when President Trump’s tariff plans triggered market-wide selling. Now, Netflix is on the verge of reaching a $500 billion market cap for the first time.

The company has proven to be largely immune to trade tensions. Netflix imports content rather than physical goods, shielding it from the impact of tariffs.

Even when Trump threatened 100% import duties on foreign movies, the stock dipped only 2%.

Investors recognize that Netflix could offset potential impacts by shifting production to the US or adjusting subscription prices.

The streaming service has historically performed well during economic uncertainty. It delivered double-digit gains during the COVID-19 pandemic as lockdowns drove viewership of hit shows.

Ad Business Gaining Momentum

Netflix’s ad-supported tier is showing strong growth. The company recently revealed it now has 94 million monthly active users for its ad tier.

This represents an increase of more than 20 million users since November and more than double the 40 million reported in May 2024.

The ad-supported plan is priced at $7.99, significantly lower than the cheapest ad-free plan at $17.99.

Netflix executives project that ad revenue will double this year. Advertising president Amy Reinhard stated that ad-supported tiers added 24 million users over the past six months.

The company plans to leverage artificial intelligence to enhance ad targeting and profitability.

Netflix will roll out its Ad Suite in EMEA next week and launch AI-powered ad formats in 2026, creating what BMO Capital analyst Brian Pitz calls “a multi-year catalyst for ad revenue growth.”

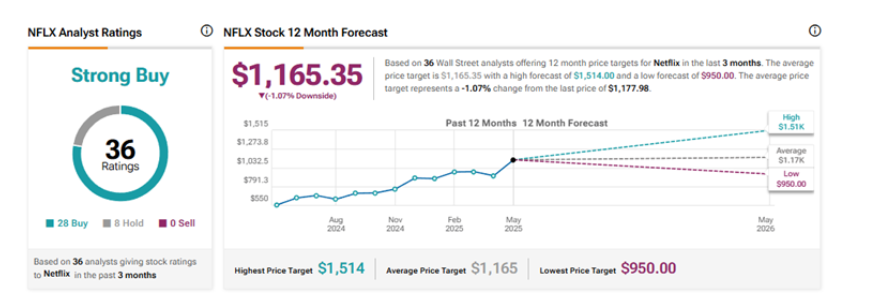

Wall Street analysts have responded positively to these developments. Evercore’s Mark Mahaney maintains a Buy rating with a $1,150 price target.

BMO Capital’s Brian Pitz reaffirmed a Buy rating with a $1,200 target. Seaport Research’s David Joyce raised his price target to $1,230 from $1,060.

Growth Beyond Streaming

The valuation question looms large for potential investors. At 43 times future earnings, Netflix trades at a premium to both the S&P 500 (21 times) and the “Magnificent Seven” tech giants (27 times).

However, the company has averaged a price-to-earnings ratio of 52 over the past five years. From this perspective, the current valuation isn’t unusual.

Baillie Gifford strategist Ben James believes Netflix’s operating margins could nearly double from the current 27% by the end of 2030.

The company has built what James calls a “flywheel” of growth, where more subscribers enable more content investment, which attracts even more users.

Netflix executives reportedly target a $1 trillion market cap by the end of 2030, according to The Wall Street Journal.

The company is also expanding beyond streaming. February saw the opening of its first restaurant, Netflix Bites in Las Vegas, featuring dishes inspired by its shows and films.

Netflix plans to launch experiential venues called Netflix Houses later this year.

Live sports programming represents another growth avenue, potentially helping the company reach new market segments.

Despite having 301.6 million global subscribers, Netflix still has room to grow. CFO Spencer Neumann previously estimated a total addressable market of 700 million to 1 billion homes.

Analysts expect Netflix’s earnings before interest, taxes, depreciation, and amortization to rise 26% this year, 20% in 2026, and 18% in 2027.

Netflix stock has rallied 32% so far in 2025, with Wall Street maintaining a Strong Buy consensus based on 28 Buy and eight Hold recommendations.