TLDR

- S&P 500 poised for fifth consecutive day of gains amid easing US-China trade tensions

- Dow Jones, Nasdaq futures trading higher in Friday premarket

- Walmart warned of potential price increases due to tariff impacts

- Bitcoin trading just under $104,000, up 0.8%

- Consumer sentiment data release expected Friday, following April’s drop in sentiment

Stock Markets Rally After US-China Tariff Rollback, But Caution Remains

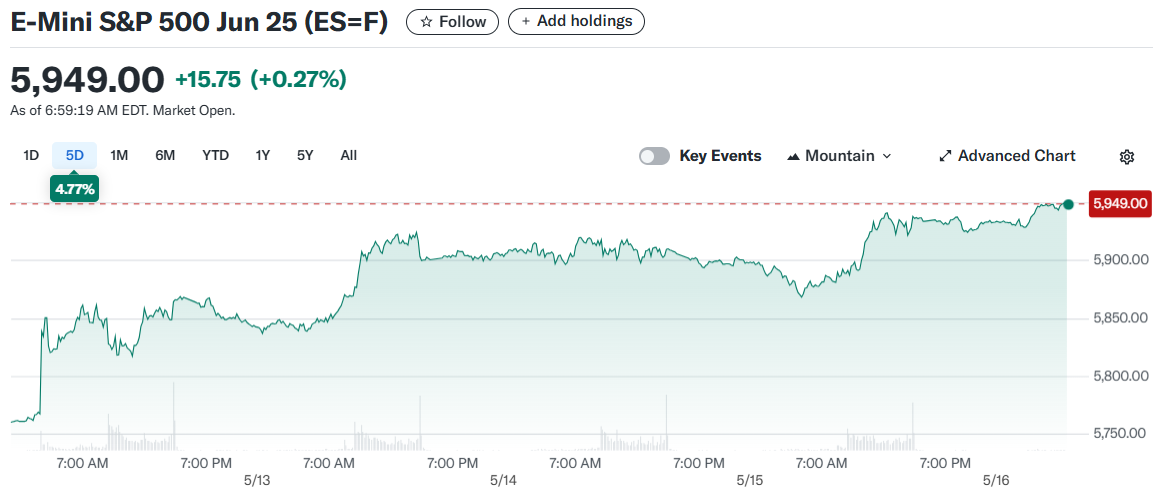

Wall Street is ending the week on a positive note as US stocks edged higher in premarket trading on Friday. This comes after the surprise US-China tariff rollback announcement kicked off the week with strong market gains. The S&P 500 futures moved up 0.2%, setting the index on track for its fifth straight day of gains. Dow Jones Industrial Average futures rose over 0.3%, while the tech-heavy Nasdaq 100 futures added 0.2%.

The broad market rally began when investors jumped back into risky assets following news of easing trade tensions between the US and China. However, initial enthusiasm has been tempered by growing concerns about the real-world impact of tariffs on the economy.

Walmart’s recent warning about tariff-fueled price hikes has introduced a note of caution into the market. The retail giant suggested consumers might face higher prices in the months ahead as a result of the trade policies.

Economic Indicators and Future Catalysts

Investors are now looking for fresh catalysts that could extend the market rally. Friday’s release of the University of Michigan’s consumer sentiment survey for May will provide insight into how Americans are handling the arrival of tariffs.

The April consumer sentiment report showed a drop in sentiment and rising inflation expectations. These concerns weren’t reflected in this week’s inflation updates, making the May data particularly important for market watchers.

The benchmark 10-year US Treasury note yield retreated 2 basis points to 4.411% on Friday. The US dollar index, which tracks the greenback against a basket of six other currencies, was down 0.3%.

Cryptocurrency markets also showed strength, with Bitcoin up 0.8% to just under $104,000. This represents continued strength in the world’s largest cryptocurrency by market capitalization.

Markets remain vigilant for the next developments in President Trump’s trade agenda. Focus has shifted to potential fresh deals and hints of changes in the improving relationship with China.

There are indications that Beijing views the 90-day pause on hiking tariffs as too short. Meanwhile, investors believe the US is likely to maintain China levies at the current pause level of 30% through late 2025, according to Bloomberg reports.

The “Magnificent Seven” megacap tech stocks struggled in Wednesday’s trading session. While the Dow and S&P 500 rose, the Nasdaq fell, highlighting the mixed response to current market conditions.

Kathleen Brooks, research director for online broker XTB, noted that improving US trade relations, especially with China, has been the chief driver of global markets this week. However, this effect appears to be fading as the week comes to a close.

Friday’s price action could indicate whether there’s appetite for a move back to the record highs from February. Investors are particularly watching for signs of continued momentum in the market rally.

Gold is set for a steep weekly loss following the US-China trade truce announcement. This reflects changing investor sentiment as risk appetite has increased in response to improving trade relations.

UnitedHealth stock rose in recent trading, providing positive momentum for the Dow Jones Industrial Average. The healthcare sector continues to be an area of interest for investors seeking stability amid changing market conditions.