TLDR:

- QUBT shares rose 11.8% in premarket trading after reporting Q1 earnings

- Company posted $0.11 EPS, beating analyst expectations of a $0.07 loss

- Q1 revenue was $39,000, missing analyst estimates of $100,000

- Net income reached $17 million compared to a $6.4 million loss in Q1 2024

- QUBT completed construction of its Quantum photonic chip foundry in Tempe, Arizona

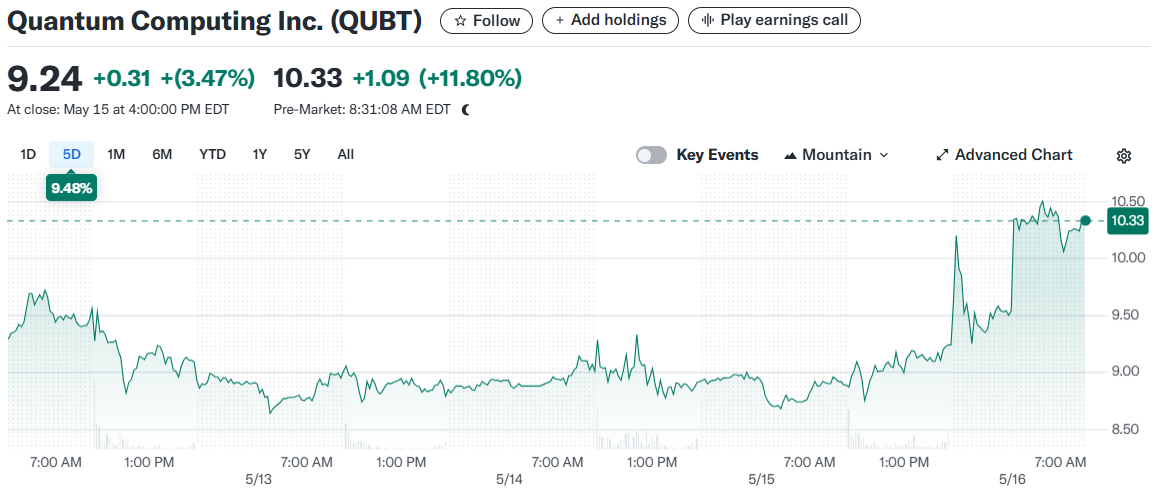

Quantum Computing Inc. shares jumped nearly 12% in premarket trading following the company’s first-quarter earnings report that delivered unexpected profits despite revenue shortfalls.

Quantum Computing Inc. (QUBT) saw its stock price climb sharply on Friday after the quantum technology company reported a surprise profit for the first quarter of 2025.

The company’s shares rose 11.8% to $10.33 in premarket trading after releasing financial results that beat earnings expectations despite falling short on revenue targets.

Quantum Computing reported first-quarter earnings of 11 cents per share, significantly outperforming analyst estimates that had projected a loss of seven cents per share.

This marks a major turnaround from the same period last year when the company posted a net loss of $6.4 million.

Revenue for the quarter came in at $39,000, which represents growth from the $27,000 reported in Q1 2024.

However, this figure missed analyst expectations of $100,000 according to data from Benzinga Pro.

Financial Position Strengthens

The company’s balance sheet showed substantial improvement during the quarter. Total assets increased to $242.5 million as of March 31, 2025, up from $153.6 million at the end of 2024.

Cash and cash equivalents saw a dramatic boost, increasing by $87.5 million to reach $166.4 million by the end of the quarter. This improved liquidity position gives the company more runway to fund its quantum computing initiatives.

Total liabilities decreased by approximately $25 million compared to year-end 2024, now standing at $21.7 million. Meanwhile, stockholders’ equity rose to $220.8 million, reflecting the company’s strengthened financial position.

The gross margin decreased to 33% from 41% in Q1 2024, showing some variability at current revenue levels. Operating expenses increased to $8.3 million from $6.3 million in the same quarter last year, primarily due to higher employee-related costs.

Operational Milestones

Quantum Computing achieved several key operational milestones during the quarter that may have contributed to investor optimism.

The company completed construction of its Quantum photonic chip foundry in Tempe, Arizona, marking an important step in its manufacturing capabilities.

This facility is expected to play a crucial role in the company’s future production plans.

QUBT also secured its fifth purchase order for foundry services from a leading Canadian research institute, suggesting growing international demand for its quantum computing capabilities.

The company announced a new collaboration with the Sanders Tri-Institutional Therapeutics Discovery Institute. This partnership will leverage QUBT’s Dirac-3 quantum optimization machine for advanced research applications.

Building on previous work with NASA, Quantum Computing secured a new subcontract with NASA’s Langley Research Center.

This agreement will apply the company’s Dirac-3 quantum machine to space agency research projects. The company also strengthened its leadership team by adding Eric Schwartz to its Board of Directors.

Schwartz brings over 20 years of experience in financing, mergers and acquisitions, and corporate strategy. Despite these positive developments, the company acknowledged it remains in the early stages of customer discovery and product validation.

This process takes time and could delay significant revenue growth in the near term. The latest quarterly results show Quantum Computing’s net income reached $17 million or $0.13 per basic share, compared to its $6.4 million loss in the first quarter of 2024.