TLDR

- Sony stock rose 5.62% in pre-market trading after strong FY2024 results

- Sales increased 7% to ¥12.04 trillion, with operating income up 23%

- Gaming, music, and imaging units fueled profit, while financial services lagged

- Tariffs are expected to impact profits by ¥100 billion in FY2025

- Sony plans PS5 production diversification, share buyback, and financial unit spin-off

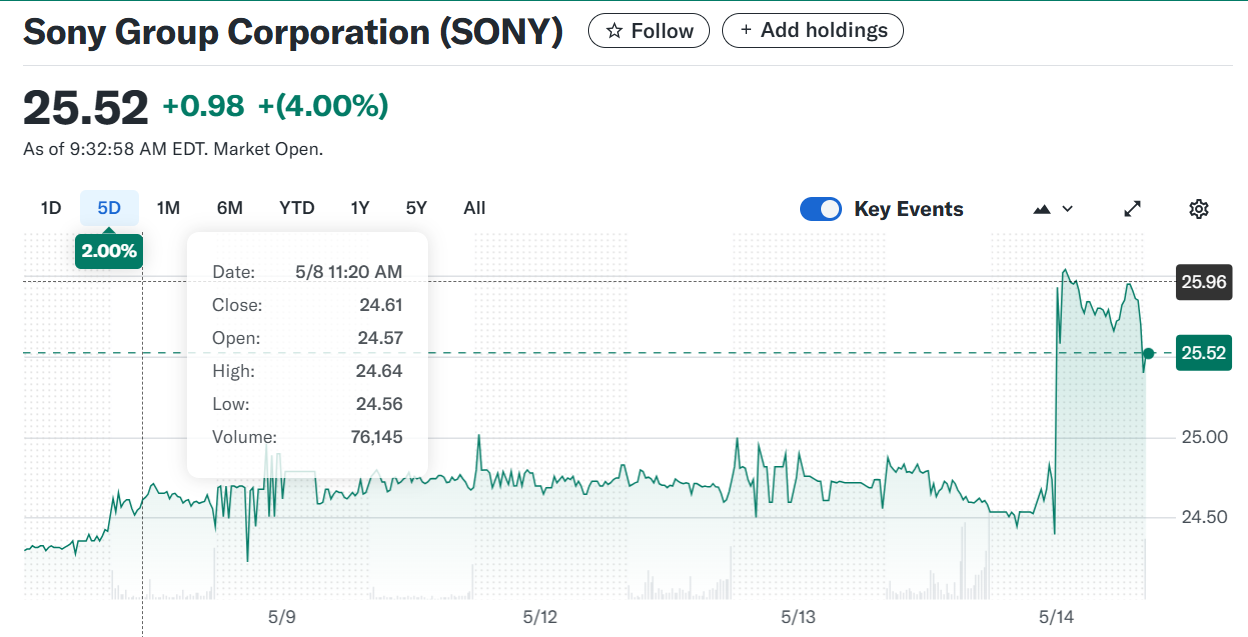

Sony Group Corporation (NYSE: SONY) closed at $24.54 on May 13, 2025, and jumped 5.62% in pre-market trading on May 14th, following robust earnings.

On May 13after market close, Sony reported a 7% increase in FY2024 sales to ¥12.04 trillion and a 23% rise in operating income to ¥1.28 trillion. These gains were driven by solid performance in the Game & Network Services, Music, and Imaging & Sensing Solutions divisions.

The Financial Services segment, however, saw a drop in both revenue and income. Despite this, Sony’s entertainment and technology-driven strategy continues to bear fruit, as seen in its 61.13% one-year return versus the Nikkei 225’s -0.59%.

Tariff Burden Clouds Future Outlook

Sony’s FY2025 outlook is less optimistic. The company expects a ¥100 billion ($685–$700 million) impact from U.S. tariffs, significantly affecting operating profit projections. Sony forecasts flat profit of ¥1.28 trillion, which missed analysts’ ¥1.5 trillion average estimate.

$Sony #PS5 sales fell 17.8% y/y in the March quarter, as rival #Nintendo gears up for the Switch 2 release next month.

Sony has already raised prices in Europe and other regions amid #Tariffs, which are taking a toll — the Japanese giant now expects a $700 million (¥100 billion)… pic.twitter.com/zVz99RXvrF

— Tradu (@TraduOfficial) May 14, 2025

Chief Financial Officer Lin Tao revealed Sony may raise hardware prices, including for the PS5, to manage the cost pressure. The company is exploring local manufacturing options in the U.S. to reduce tariff exposure.

Gaming Division Faces Slowdown

PS5 sales fell 37% in the March quarter. Sony now projects 15 million unit sales for the fiscal year ending March 2026, down from 18.5 million the previous year. The gaming segment, while still vital, is under pressure due to delayed blockbuster releases like GTA VI and competition from Nintendo’s upcoming Switch 2.

Sony’s leadership acknowledged the PS5’s maturing life cycle. CEO Hiroki Totoki stated they will “flexibly adjust shipments” in response to market dynamics and maintain focus on profitability.

Other Units and Corporate Moves

Sony’s image sensing business posted flat profit in Q1, with sales rising under 3%. Though facing challenges from mobile phone tariffs, Totoki expects long-term growth in mobile image sensors.

Sony also plans to spin off its financial business, listing it separately on September 29, 2025. It will treat the unit as discontinued from the current quarter. Meanwhile, the company announced a ¥250 billion share buyback to enhance shareholder returns.

Market Response and Long-Term Performance

Sony shares gained 3.7% in Tokyo following the earnings release. With a 96.73% five-year return compared to the Nikkei 225’s 91.46%, Sony has outperformed its benchmark. Still, navigating trade tensions and maintaining momentum in key hardware and entertainment sectors will be critical for sustaining long-term gains.