When the crypto market drops, fear takes over. Prices fall fast, headlines sound alarmed, and many retail traders rush to exit. But for others, these moments offer something different—an entry point few are brave enough to take.

Some investors now depend on AI models to help make sense of it all. These systems can process massive amounts of blockchain data, scan trading volumes, monitor sentiment shifts, and flag tokens that may be undervalued. That kind of machine-led insight is starting to shape how crypto decisions are made, especially when the market cools.

One project that’s quietly caught the attention of AI-focused investors is Dawgz AI, a penny crypto blending blockchain utility with artificial intelligence. As the conversation shifts from hype to use case, projects like this are being watched more closely during the current dip.

Why Investors Track Dips Instead of Fearing Them

Price dips are not unusual in crypto. Historical data shows that many well-known tokens have dropped sharply before seeing new all-time highs. Bitcoin has had several pullbacks of over 70% followed by significant recoveries. According to CoinMarketCap, bear markets tend to shake out weaker hands while opening the door for long-term positions that often lead to gains.

Some investors now take a more structured approach during downturns. Instead of reacting emotionally, they watch for strong utility, developer activity, and consistent user growth. Platforms like CoinGecko help track active DeFi projects, while DefiLlama gives insight into total value locked across chains. These tools support decisions that focus on value, not just short-term price.

Retail and institutional traders are also starting to integrate AI tools into their strategy. These tools can monitor token metrics, on-chain signals, and community trends in near real time. According to Forbes Digital Assets, some traders are building custom models that suggest buying zones based on volatility and liquidity. Rather than guessing, they look for patterns that align with solid blockchain use and consistent user behavior.

What Makes a Penny Crypto Worth Watching in 2025

Penny cryptos attract attention for their low entry price, but that alone does not make them worth buying. What matters is the foundation behind the token. Investors often look for projects that serve a real purpose. It could be through smart contracts, automation tools, or platforms that help solve problems in finance, gaming, or AI integration.

Token supply and distribution also play a major role. A token that shows high concentration in a few wallets carries more risk. Platforms like Coinbase explain how tokenomics works and why it’s important. Transparency around circulating supply and how new tokens are released helps investors avoid coins designed only for short-term hype.

Strong community support and ongoing development matter just as much. A project that consistently pushes code and interacts with its user base builds trust. Sites like CoinGecko and GitHub let investors see activity levels. Many crypto enthusiasts now combine on-chain data with open-source tools to measure a project’s health. This kind of research helps filter out noise and focus on tokens that show real movement even during market dips.

How AI Is Influencing Modern Crypto Buying Decisions

Artificial intelligence is now playing a role in how traders and investors approach crypto research. It helps process large volumes of market data that would be impossible to review manually. Some tools scan on-chain activity, exchange volumes, and wallet movements to flag projects showing early signs of growth. According to CoinDesk, AI-based models are being used to identify patterns that could signal momentum shifts before they appear on charts.

AI systems are not only tracking prices. They also monitor social sentiment across platforms like Reddit, Twitter, and Discord. When unusual spikes in engagement happen, those tools highlight the tokens receiving more attention. This kind of monitoring helps detect early-stage interest that may lead to larger adoption. Reports from The Guardian note that some funds now use AI to review real-time sentiment as part of their risk assessment.

This new approach does not replace fundamental research. Instead, it adds another layer of data to improve decision-making. AI-backed insights are helping some investors spot under-the-radar tokens that might not have strong visibility yet. One such project gaining quiet attention during this shift is Dawgz AI, a penny crypto using AI technology on the Ethereum network. Its focus on blockchain utility rather than hype makes it a topic of interest for traders using AI tools to guide their watchlists.

4 Cryptos Investors Are Watching During This Dip

Dawgz AI (DAGZ) – AI-Powered Meme Coin with Utility

In the current crypto market, investors are increasingly attentive to projects that combine practical utility with engaging community elements. One such project that has garnered attention is Dawgz AI, which integrates artificial intelligence with the viral appeal of meme culture.

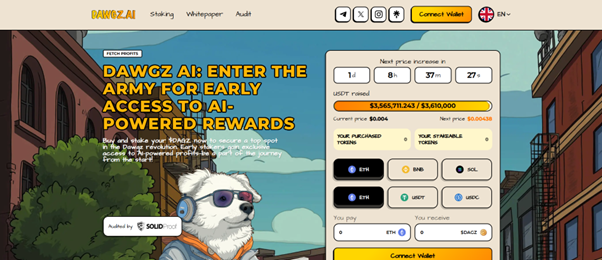

Dawgz AI operates on the Ethereum blockchain and offers AI-powered trading tools designed to assist users in navigating market trends. The project has successfully raised over $3.5 million in its presale phase, indicating strong investor interest. The current token price stands at $0.004, with a total supply of 8.88 billion tokens.

SolidProof has audited Dawgz AI’s smart contract to improve transparency and security. The project’s tokenomics allocate 30% of the total supply to the presale, 20% to staking rewards, and 15% to community incentives. This structured approach aims to promote a sustainable and engaged community around the token. Watch this video for more details.

Ethereum (ETH) – The Smart Contract Pioneer

Ethereum remains a foundational platform for decentralized applications and smart contracts. Its recent Pectra upgrade introduced improvements aimed at improving transaction speed and reducing costs. Despite facing competition, Ethereum’s extensive developer community and widespread adoption maintain its relevance.

According to Binance, as of May 15, 2025, Ethereum is trading at $2,589.01 with a market cap of $312.57 billion. The platform continues to host a significant portion of decentralized finance (DeFi) and non-fungible token (NFT) projects.

Investors often view Ethereum as a long-term asset due to its strong infrastructure and ongoing development efforts. Its role in supporting a wide range of blockchain applications keeps it at the forefront of the crypto space.

Polygon (MATIC) – Scalable Layer-2 Solution

Polygon offers a Layer-2 scaling solution for Ethereum, aiming to improve transaction throughput and reduce fees. It provides a framework for building and connecting Ethereum-compatible blockchain networks. Polygon’s ecosystem supports various decentralized applications and services.

According to CoinMarketCap, as of May 15, 2025, Polygon’s MATIC token is priced at $0.2381 with a market capitalization of $2.48 billion. The platform’s scalability solutions have attracted numerous projects seeking efficient blockchain infrastructure.

Polygon’s commitment to improving Ethereum’s capabilities positions it as a valuable asset for developers and investors interested in scalable blockchain solutions. Its growing adoption reflects the demand for efficient and cost-effective platforms in the crypto industry.

Render (RNDR) – Decentralized GPU Rendering

Render provides a decentralized network for GPU-based rendering, catering to industries like gaming, virtual reality, and digital art. By leveraging blockchain technology, Render aims to connect users in need of rendering services with those who have idle GPU capacity.

The RNDR token is currently valued at $4.82, with a market cap of $2.50 billion, as per Binance. The platform’s utility in facilitating decentralized rendering services has garnered attention from content creators and developers.

Render’s approach to distributing rendering tasks through a decentralized network offers a unique solution in the digital content creation space. Its integration of blockchain technology addresses the growing demand for efficient and scalable rendering services.

How to Evaluate Penny Tokens During a Dip

When prices fall, it becomes easier to see which tokens are supported by real demand. A project that continues to show development activity and user growth even during a dip often signals long-term value. Platforms like CoinGecko and DefiLlama offer open access to token metrics, including liquidity, volume, and protocol usage. These tools help investors assess whether a token is showing signs of strength or simply moving with market trends.

AI is now part of this process. Some traders use AI-backed models to scan tokens based on utility, market behavior, and wallet distribution. These tools can identify unusual on-chain activity or sentiment spikes that point to early-stage momentum. According to CoinDesk, AI-based filters are being added to traditional dashboards to bring more clarity to the research process. Investors now combine machine learning with manual review to reduce guesswork and improve timing.

For those looking to identify the best crypto to buy in dip, it helps to focus on more than just price action. Smart money often follows use case, consistency, and tokenomics. When a token aligns with real utility and community traction, it may become part of a longer-term strategy rather than just a quick trade.

Wrap Up: Why Dawgz AI Is Being Talked About in 2025

Crypto dips have always drawn mixed reactions. Some exit too early, while others use the opportunity to find real value beneath the noise. In this current cycle, more investors are turning to data and AI tools to guide those decisions. This shift in how people approach the market is reshaping the way they identify long-term plays.

Dawgz AI is gaining attention not because it follows trends but because it brings something more structured to the table. It uses AI-backed features to create real interaction and aims to support utility rather than hype. The project’s smart contract audit, steady funding, and growing user base are all signals that many investors now use to separate potential from speculation.

If you’re exploring smart picks during a dip and want something that combines innovation with accessibility, Dawgz AI is worth watching. You can review its tokenomics, AI integration, and contract audit. Discover what Dawgz AI is building and why more crypto enthusiasts are paying attention. Visit Dawgz AI to explore the project.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.