TLDR

- Revenue drops 41 % with Q1 at $70.1 M

- Net income hits $409.5 M thanks to $503 M in noncash gains

- Self-mining hashrate up 44.8 % while BTC mined falls to 350

- SEALMINER R&D triples to $59 M

- Stock down 2.56 % after earnings

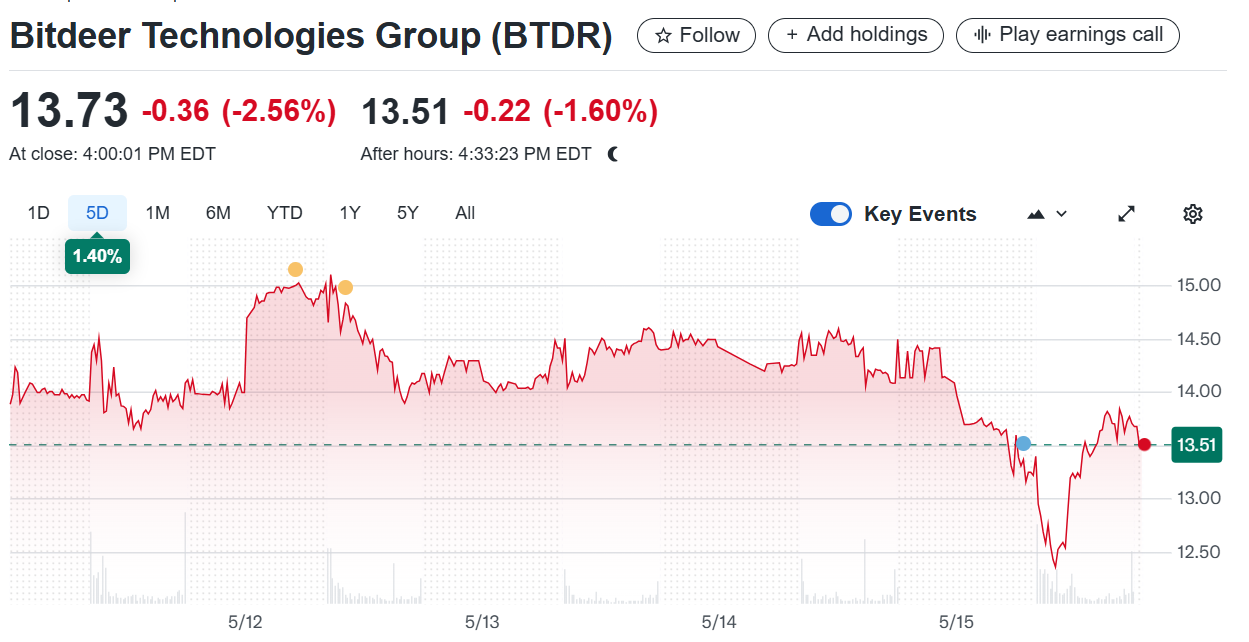

Bitdeer Technologies Group reported a 41.3% revenue drop in Q1 2025 compared to last year’s quarter. Despite this sharp decline, the company posted a net income of $409.5 million, driven by non-cash gains. The stock closed at $13.73, down 2.56%, and fell further after-hours to $13.51.

Bitdeer Technologies Group (BTDR)

Revenue Down, Margins Suffer

The company generated $70.1 million in total revenue, falling short of the $119.5 million reported in Q1 2024. The decline came mainly from reduced hosting services and the expiration of cloud mining contracts. Gross profit turned negative at $3.2 million, with a gross margin of -4.6%.

Bitdeer’s Cloud Hash Rate revenue dropped nearly 99% due to reallocating rigs to self-mining operations. General Hosting and Membership Hosting revenues fell 66% and 16.4% after customer downsizing. The April 2024 Bitcoin halving and reduced mining economics drove the changes.

Self-Mining Expands Amid Headwinds

Self-mining revenue was $37.2 million, down from $48.4 million last year. However, the average self-mining hashrate rose by 44.8% to 9.7 EH/s, supported by SEALMINER A1 and A2 deployment. Despite these efforts, total Bitcoins mined declined sharply from 911 to 350 in the quarter.

Operational efficiency declined slightly, with miner efficiency dropping to 29 J/TH from 31.7 J/TH year-over-year. Even so, Bitdeer increased its Bitcoin holdings to 1,156, up from 58 a year ago. The company continues to expand its infrastructure to support increased self-mining capacity.

SEALMINER Development Drives Costs

R&D expenses nearly tripled to $59 million due to SEALMINER chip development and associated engineering costs. General and administrative expenses held steady at $15.4 million, while selling expenses stayed flat at $1.4 million. The company plans to achieve 40 EH/s in self-mining capacity by October 2025.

JUST IN: 📉@BitdeerOfficial reveals Q1 2025 financial results, showing a net income of $409.5M, a significant jump from $0.6M last year, despite a revenue drop to $70.1M. Gross profit turned negative at $3.2M. Company targets 40 EH/s hashrate by Oct 2025. $BTDR pic.twitter.com/BRgMZFjMnZ

— Bitcoin Mining Stock (@miningstockinfo) May 15, 2025

Total operating expenses reached $75.8 million, more than double from a year earlier. Despite these costs, Bitdeer reported a $503.1 million gain from fair value derivative changes. These gains, tied to Tether warrants and convertible notes, significantly boosted net income.

Cash Flow and Capex Adjustments

Operating cash outflows totaled $284 million, driven by supplier payments for SEALMINER mass production. The company spent $73.6 million on investing activities, including $18.2 million on cryptocurrency purchases. Financing activities brought in $94.9 million, primarily from issuing new shares.

Capex guidance for 2025 was reduced to $260–$290 million, down from $340–$370 million. This change came after construction at the Ohio site was paused due to AI-related development discussions. Cash and equivalents stood at $215.6 million, while cryptocurrencies were valued at $131.1 million.

Stock Performance and Outlook

Bitdeer shares have gained 116.21% over the past year but declined 14.61% in the last three months. The company saw four negative EPS revisions over the previous 90 days and reported a Q1 loss of $0.37 per share. Despite weak near-term financial health, management remains focused on expanding mining efficiency and AI opportunities.