TLDR

- Trump’s 90-day US-China trade war thaw cuts tariffs from 145% to 30% on Chinese goods

- Wall Street economists reducing recession probability estimates from as high as 60% to around 35-45%

- US effective tariff rate has dropped from about 24% to 14%, creating a “$300 billion tax cut” for consumers

- Despite improvements, tariffs remain at highest levels since 1910, with long-term economic uncertainty

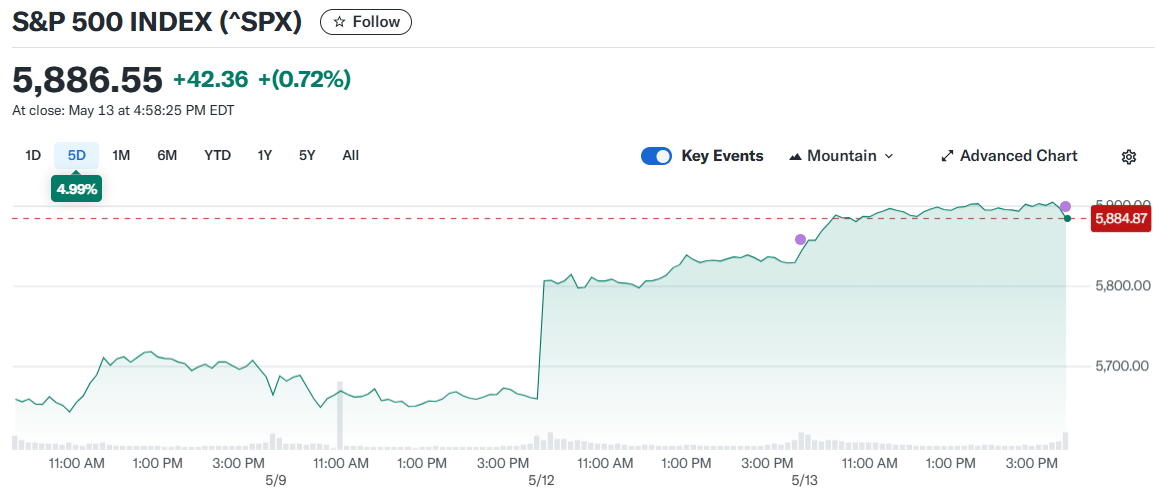

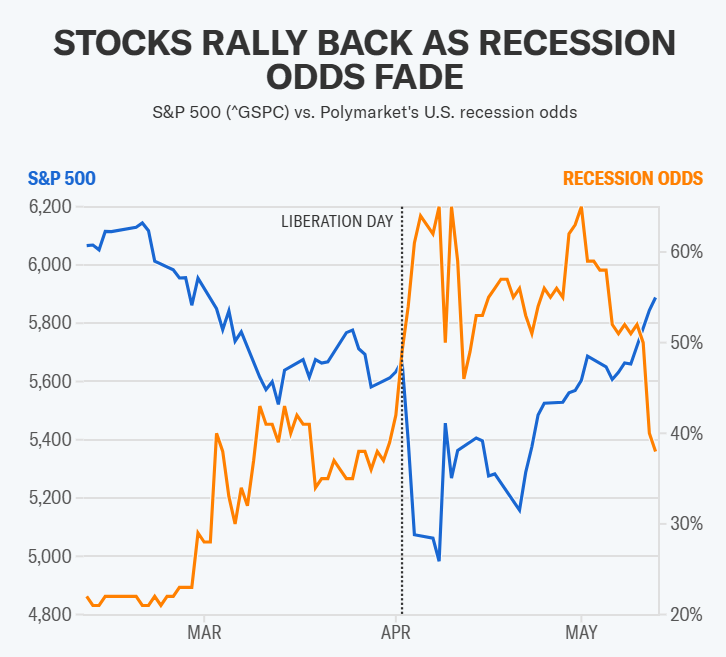

- Markets responding positively with multiple firms raising S&P 500 year-end targets

President Donald Trump has stepped back from the brink of a trade war that threatened to push the US economy into recession. In a dramatic move announced Monday, the administration unveiled a breakthrough with China that calls for a 90-day reduction in tariffs from a punishing 145% to 30%, offering immediate relief to markets and businesses.

The decision came as supply chain experts warned of imminent problems, including potential empty store shelves. “This staves off the really disastrous consequences that were about to hit the US economy,” said Erica York, vice president of federal tax policy at the Tax Foundation.

The announcement triggered an immediate positive reaction on Wall Street. Investment firms have begun raising their year-end targets for the S&P 500, with Yardeni Research boosting its forecast from 6,000 to 6,500 and Goldman Sachs moving from 5,900 to 6,100.

Despite the improvement, economists caution that the US economy isn’t out of danger yet. Moody’s Analytics calculates that the US effective tariff rate has dropped from 21.3% to 13.7% based on the new trade framework. While lower, this still represents the highest tariff level since 1910.

At this level, tariffs are expected to add more than one percentage point to US inflation through next year and subtract the same amount from GDP growth, according to Mark Zandi, chief economist at Moody’s Analytics.

Wall Street Reassesses Recession Risk

The tariff reduction has prompted major Wall Street institutions to scale back their recession forecasts. JPMorgan’s Michael Feroli, who was the first to predict a recession after Trump’s initial tariff increase, now believes “recession risks are still elevated, but now below 50%.”

Goldman Sachs has lowered its recession probability for the next 12 months to 35% from 45% while raising its GDP forecast to 1% from 0.5%. Barclays has completely removed its recession call.

Mark Zandi of Moody’s Analytics now sees a 45% chance of recession this year, down from a peak of 60%. “The economy will have a tough year but should avoid a recession,” Zandi said, though he cautioned that “the economy will be highly vulnerable to anything else that might go wrong.”

The reduction in Chinese tariffs amounts to approximately a $300 billion “tax cut” for American consumers who would have otherwise absorbed higher prices. This relief should help maintain consumer spending, a critical driver of economic growth.

However, the trade situation remains precarious. The current arrangement is only a 90-day pause, not a permanent solution. When asked if tariffs would return to 145% if no deal is reached, Trump indicated they would increase “substantially” but expressed optimism about reaching an agreement.

Uncertainty persists as sector-specific tariffs still loom over various industries. The Commerce Department recently launched a national security probe into imports of airplanes, jet engines and parts, potentially setting the stage for aerospace tariffs.

The rapid policy shifts have created unprecedented levels of uncertainty. An index measuring trade policy uncertainty in major US newspapers reached record highs unseen since tracking began in the 1960s.

“It’s absolutely a manufactured crisis,” said Douglas Holtz-Eakin, president of the American Action Forum and former economic adviser to Republicans. “We still have tariffs at levels we haven’t seen in a century. That’s a substantial tax increase.”

The administration’s decision to pull back appears to have been influenced by several factors. A senior administration official told CNN that Trump has been sensitive to both the prospect of empty store shelves and negative market reactions to the deepening trade war.

“Both sides luckily decided to save Christmas,” noted Peter Boockvar, chief investment officer at Bleakley Financial Group, referring to concerns about holiday season supply disruptions.

While the immediate crisis appears averted, economists warn that damage to confidence and trade flows won’t be instantly repaired. The disruption to supply chains caused by the tariff uncertainty will take time to resolve.

The pause in the trade war has improved the economic outlook, but as University of Michigan economics professor Justin Wolfers put it: while the situation is “much better today than it was yesterday,” it’s also “much worse today than on Inauguration Day.”

As of May 14, the betting market Polymarket shows recession odds have tumbled from 51% last Friday to below 40% following the tariff reduction announcement. US Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer held a news conference in Geneva on May 12 to provide details on the progress made during meetings with Chinese officials.