TLDR

- Bitcoin ETF inflows dropped by 67 percent to $599.59 million for the week ending May 8.

- This marks the lowest weekly inflow for Bitcoin ETFs since mid-April and the second consecutive weekly decline.

- BlackRock’s IBIT led with $356.20 million in daily inflows on May 9 and now holds $64.45 billion in assets.

- Fidelity’s FBTC secured $45 million in daily inflows while its total assets rose to $20.54 billion.

- Grayscale’s GBTC continued to face net outflows with $65.16 million withdrawn on May 9.

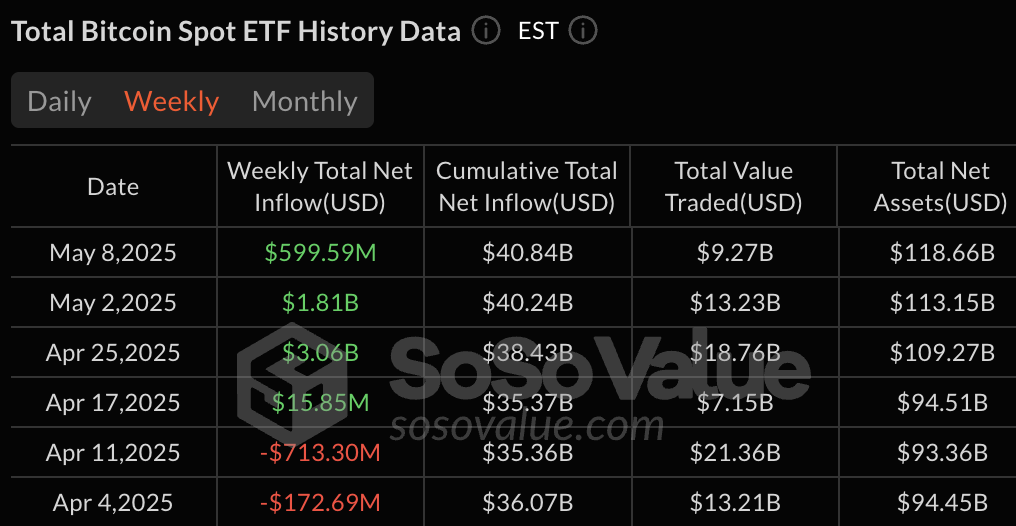

Bitcoin ETF inflows dropped sharply during the week ending May 8, despite Bitcoin’s continued price strength. Total weekly inflows fell to $599.59 million, down 67% from the previous week’s $1.81 billion. This marked the lowest weekly inflow for Bitcoin ETFs since mid-April and continued a two-week trend of declining new capital.

BlackRock’s IBIT Remains Dominant Despite Overall Drop

BlackRock’s IBIT continues to lead the Bitcoin ETF space with a strong asset base and high inflows. The fund added $356.20 million in net inflows on May 9, topping the daily chart again. Its total assets reached $64.45 billion, holding over half of all Bitcoin ETF assets.

The product’s cumulative inflows since inception reached $44.71 billion, reinforcing its strong market position. Trading volumes remained solid, contributing to IBIT’s market presence, while price performance on May 9 was positive. The ETF benefited from capital inflow and Bitcoin’s price gains, driving asset growth.

- Weekly Bitcoin ETF inflow data. Source: SosoValue

Daily volume for IBIT supported the broader market trend, with overall ETF turnover dropping from recent highs. Weekly volume declined to $9.27 billion, down from $13.23 billion the prior week. IBIT, however, maintained steady performance across trading activity and inflow metrics.

Fidelity’s FBTC Holds Second While Grayscale’s GBTC Sees Continued Outflows

Fidelity’s FBTC stood firm in second place among Bitcoin ETFs, with $20.54 billion in total assets. On May 9, it saw $45 million in daily inflows, reflecting moderate demand. FBTC’s consistent growth highlighted a stable position in the competitive ETF landscape.

Grayscale’s GBTC, however, reported persistent outflows, with $65.16 million in net redemptions on May 9. Its total assets dropped to $19.47 billion, narrowing the gap with FBTC. Unlike spot ETFs with new inflows, GBTC faces net outflows weekly.

Overall sentiment varied between the two funds as FBTC retained inflows while GBTC saw withdrawals. GBTC has now lost ground regarding total assets to IBIT and FBTC. The gap widens further as Bitcoin ETF investors prefer lower-fee or spot-based alternatives.

Other Bitcoin ETFs Show Mixed Results as Trading Volumes Decline

Ark’s ARKB increased to $4.99 billion in assets, gaining from positive price movements and limited inflows. Franklin’s EZBC led daily price action with a 0.16% gain on May 9, while ARKB and BRRR followed at 0.14%. However, Bitwise’s BITB recorded outflows of $14.59 million, showing diverging sentiment.

Despite the decline in overall inflow, daily flows remained positive, with $321.46 million recorded on May 9 across all ETFs. Aggregate daily trading volume reached $2.67 billion, reflecting continued but reduced activity. All funds except Hashdex’s DEFI posted price gains on the day.

Total net assets across all Bitcoin ETFs rose to $121.19 billion on May 9, up from $113.15 billion on May 2. About 34% of this came from cumulative inflows, showing that new capital supports asset growth.