TLDR

- Coinbase stock fell 7% following news of a customer data breach and ongoing SEC investigation

- Hackers bribed overseas support agents to steal user data, demanding a $20 million ransom

- Coinbase expects to spend $180-400 million on customer reimbursements and remediation

- The SEC is investigating Coinbase’s 2021 claim of “100+ million verified users”

- These challenges come as Coinbase prepares to join the S&P 500 index

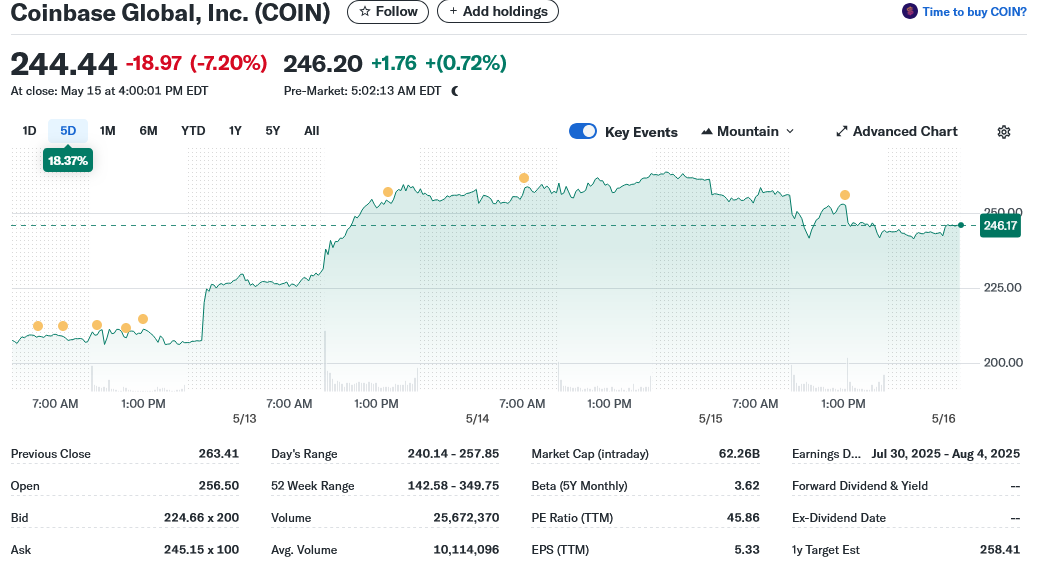

Coinbase shares tumbled 7% to $244 after the cryptocurrency exchange was hit with a double dose of bad news.

The company revealed that hackers had bribed overseas customer support agents to steal user data while simultaneously confirming an ongoing SEC investigation into potentially inflated user metrics from 2021.

The data breach affected less than 1% of Coinbase’s daily active users. Hackers managed to recruit several overseas support staff who then leaked private customer information.

The attackers demanded a $20 million ransom to prevent public disclosure of the hack.

“These attackers have been contacting our overseas customer support agents, looking for a weak leak, someone who would accept a bribe in exchange for sharing some customer information with them,” explained Coinbase CEO Brian Armstrong in a video message.

“Sadly, they came upon a few bad apples,” he added.

Rather than pay the ransom, Coinbase has committed to fully reimbursing customers who lost funds after being tricked into transferring cryptocurrency to fraudulent accounts.

The company estimates these reimbursements and related remediation expenses could cost between $180 million and $400 million.

In response to the breach, Coinbase has fired the compromised staff members and reported them to law enforcement. The company has also established a $20 million reward fund for information leading to the arrest and conviction of the hackers.

Security Issues Mounting

The data breach comes at a time when the broader cryptocurrency sector faces growing security challenges. According to research firm Chainalysis, cryptocurrency-related hacks are projected to cost about $2.2 billion in 2024 alone.

“Unfortunately as our fledgling sector grows rapidly, it attracts the eye of bad actors, who are becoming increasingly sophisticated in the scope of their attacks and harnessing new AI tools and techniques to bypass fraud prevention measures,” said Nick Jones, founder and CEO of crypto platform Zumo.

Compounding Coinbase’s security troubles is confirmation of an ongoing SEC investigation. The regulator is examining whether Coinbase exaggerated its user counts in past disclosures.

The probe focuses specifically on Coinbase’s claim of having “100+ million verified users” that appeared in its marketing materials and IPO documentation in 2021.

Paul Grewal, Coinbase’s Chief Legal Officer, described the investigation as “a hold-over inquiry from the previous administration about a metric we stopped reporting two and a half years ago, which was fully disclosed to the public.”

Grewal noted that Coinbase now focuses on “the more pertinent statistic of monthly transacting users” instead.

The company discontinued reporting the “verified users” metric in 2022, stating in financial filings that it no longer believed the figure provided meaningful information about business performance.

To address the SEC inquiry, Coinbase has engaged the law firm Davis Polk & Wardwell.

Critical Timing

These challenges couldn’t come at a more pivotal moment for Coinbase, which is preparing to join the S&P 500 index next week.

The inclusion in this prestigious index represents a major milestone for cryptocurrency acceptance in mainstream finance. It will result in Coinbase stock being added to many index-tracking funds.

Despite dropping the “verified users” metric in 2022, the SEC probe has continued even after the regulator dropped its 2023 enforcement lawsuit against Coinbase under the Trump administration.

The combined news of the data breach and ongoing SEC investigation sent Coinbase stock sliding 7% in morning trading on Friday, May 16, 2025.

Coinbase has confirmed it will implement additional consumer protections to prevent similar security breaches in the future.

The latest security incident follows a pattern of challenges facing cryptocurrency companies as they grow and attract more attention from both investors and malicious actors.

The company’s planned entry into the S&P 500 next week remains on track despite these recent setbacks.