TLDR:

- Nu Holdings Q1 EPS of $0.11 missed analyst estimates of $0.12

- Revenue exceeded expectations at $3.25B vs consensus of $2.64B

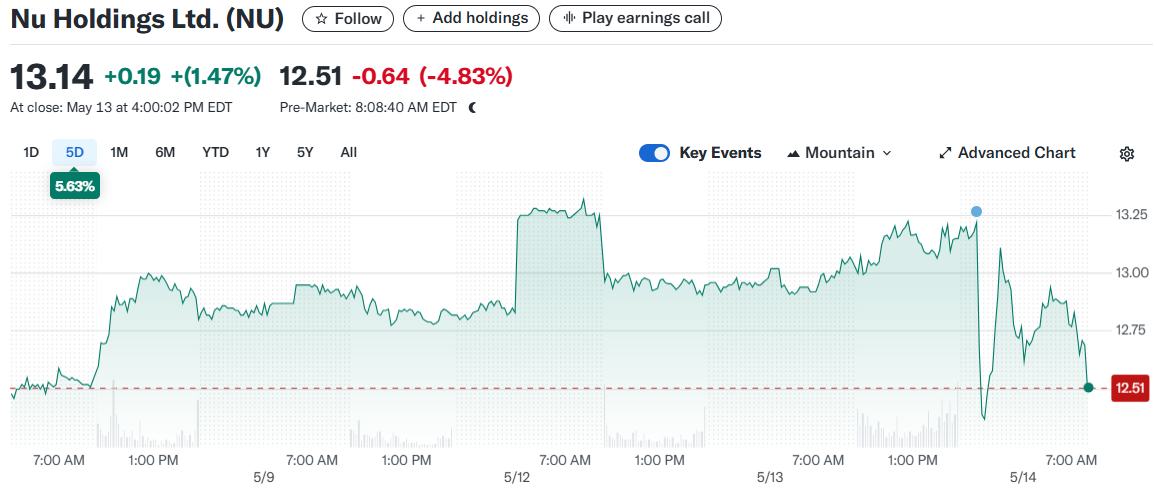

- Stock price at $13.14, down 4.09% over 3 months but up 13.77% in past year

- Adding over 1 million customers monthly in Brazil, now the country’s third-largest financial institution

- Barclays raised price target to $16, citing strength in personal lending

Nu Holdings reported mixed first quarter results with earnings falling short of analyst expectations while revenue significantly exceeded forecasts. The digital banking platform continues to expand its customer base in Brazil at an impressive rate of over 1 million new customers monthly.

The company’s stock closed at $13.14, showing mixed performance with a 13.77% gain over the past 12 months despite a 4.09% decline in the last quarter. Recent analyst activity includes Barclays raising its price target on Nu Holdings to $16 from $15 while maintaining an Overweight rating.

Brazilian Growth Engine

Nu Holdings continues to dominate the Brazilian market, which serves as the primary driver of the company’s expansion. In 2024, the company added more than 1 million customers per month in Brazil, now serving 58% of the country’s population.

This impressive growth has positioned Nubank as the third-largest financial institution in Brazil by customer count. The Brazilian market shows strong engagement with an 83.1% monthly activity rate.

The company is seeing particular traction in the high-income segment. Its premium credit card offering, Ultravioleta, experienced a 132% year-over-year increase in customers, reaching approximately 700,000 users.

Purchase volume through credit cards grew 106% in the fourth quarter of 2024, showing robust consumer spending through Nu’s platform.

Expanding Beyond Core Banking

Nu Holdings is working to monetize its large customer base through its Money Platform in Brazil. This includes several initiatives beyond traditional banking services.

The company has launched NuMarketplace and NuTravel to provide additional services to its customers. These platforms help Nu extract more value from its existing user base.

Nu has also entered the mobile virtual network operator (MVNO) space with the launch of NuCel. This move represents another avenue for customer monetization and service expansion.

Despite these positive developments, Nu faces challenges from currency fluctuations. The company reports earnings in U.S. dollars but generates revenue in Brazilian reais, Mexican pesos, and Colombian pesos.

The depreciation of these emerging market currencies has created headwinds for the company’s reported results. This factor may contribute to investor hesitation despite strong operational performance.

White Falcon Capital Management, in its Q4 2024 investor letter, maintained its positive outlook on Nu despite these currency challenges. The investment firm cited Nu’s “large market opportunity, strong moat driven by its superior cost structure, and brilliant management team.”

BMO private wealth chief market strategist Carol Schleif recently discussed market trends that affect stocks like Nu. She emphasized that markets often move ahead of economic realities and quickly shift focus as part of their discounting mechanism.

Schleif noted that despite expectations of tariffs rising from under 3% to approximately 10%, markets and companies are likely to adjust to these changes.

According to InvestingPro, Nu Holdings’ Financial Health score is rated as “good performance.” However, the company has seen mixed EPS revisions, with 1 positive and 3 negative revisions in the last 90 days.

The stock maintains substantial trading liquidity with a 3-month average daily volume of 59.77 million shares. This high volume indicates strong investor interest and provides good market liquidity.

Hedge fund participation shows 79 funds holding positions in Nu Holdings as of Q4 2024, demonstrating institutional confidence in the company’s prospects.

On April 25, Barclays raised its price target on Nu Holdings to $16 from $15 while keeping an Overweight rating. The adjustment came after analysts noted Nu’s strength in personal lending, one of its core business areas.

Nu Holdings reported first quarter EPS of $0.11, missing the analyst estimate of $0.12. However, revenue for the quarter came in at $3.25 billion versus the consensus estimate of $2.64 billion, a substantial outperformance on the top line.